What is the Stacked Income Protection Plan?

The Stacked Income Protection Plan (STAX) is a new crop insurance product for upland cotton that provides coverage for a portion of the expected revenue for your area. Most often your area will be your county, but it may include other counties or even practices as necessary to obtain a credible amount of data to establish an expected yield and premium rate.

STAX may be purchased on its own, or in conjunction with another policy — including Yield Protection, Revenue Protection, Revenue Protection with the Harvest Price Exclusion, and any of the Area Risk Protection Insurance policies. We refer to this as a “companion policy.” The Federal government will pay for 80 percent of the premium cost for STAX.

How does STAX work?

STAX provides coverage for up to 20 percent of the expected area revenue in increments of 5, 10, 15 or 20 percent. Loss payments begin when area revenue falls below 90 percent of its expected level – although a lower loss trigger may be selected. Loss payments reach their maximum when area revenue falls to 70 percent of its expected level – unless your companion policy has a coverage level above 70 percent in which case payments end sooner. Like other area plans of insurance, the amount of coverage may also be increased or decreased by selection of a protection factor so that growers may better tailor their coverage to their risks.

The amount of STAX coverage depends on the expected yield, projected price, coverage range, and protection factor. The expected yield for STAX will be based on the historical average of yields in the county reported to RMA by insured growers. In areas where the yield data are thin, counties will be combined in order to accumulate enough data to determine expected yields and premium rates. STAX pays a loss on an area wide basis, and an indemnity is triggered when there is an area loss in revenue.

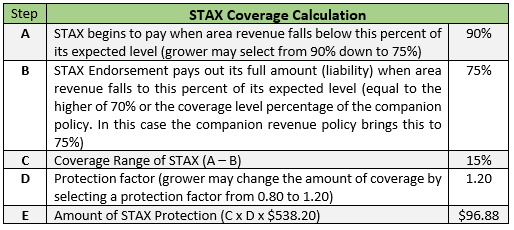

It is easiest to explain how STAX coverage is determined through an example shown in the tables below. We’ll use cotton with an expected crop value for the area of $538.20 per acre (690 pounds at $0.78 per pound). Assume the grower also purchases a Revenue Protection policy with a 75 percent coverage level – this is the ‘companion policy. The purchase of the Revenue Protection policy is not necessary to purchase STAX.

In this example, the STAX Endorsement begins to pay when area revenue falls below 90 percent of its expected level. The full amount of the STAX coverage is paid out when the area average revenue falls to 75 percent.

The dollar amount of STAX coverage is based on the coverage range and protection factor selected. In this example there are 15 percentage points of coverage – from 90 percent down to 75 percent — and the protection factor selected is 1.20. 15 percent of the expected area revenue, times the selected protection factor of 1.20, is $96.88 (or 15 percent x 1.20 x $538.20). Thus, the STAX policy can cover up to $96.88 in addition to what is covered by the companion policy.

STAX payments are determined only by area average revenue, and are not affected by whether a grower receives a payment on their companion policy (if purchased). So it is possible for a grower to experience an individual loss on his or her companion policy, but not trigger an area-based STAX payment (i.e. grower does poorly but the overall area does well), or vice-versa.