|

Yield Protection |

How Yield Protection Works

YP is available for: Barley, Canola, Corn, Cotton, Dry Beans, Dry Peas, Grain Sorghum, Peanuts, Popcorn, Rice, Soybeans, Sunflowers, and Wheat

Yield Protection is very similar to the Actual Production History (APH) policy in that it insures producers against a loss in yield due to an insurable cause of loss. The main difference between the 2 policies is the price used to determine the value of the crop. APH uses a price established by RMA while YP uses a price that is established by averaging a futures contract price from a board of trade over a given period of time known as the “Discovery Period”. This price is called the “Projected Price” and the parameters outlining the futures contract, board of trade and discovery period can be found in the Commodity Exchange Price Provisions (CEPP).

Coverage Level

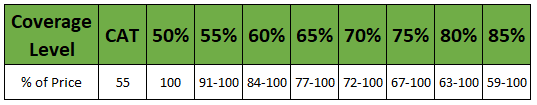

The grower elects to insure a percentage of their historical average known as the Approved APH. Coverage levels available range from: 50% to 75% (80% & 85% levels are available for some crops) in 5% increments. Some crops allow for separate coverage levels by type or by irrigation practice.

Price Election

The producer can also elect to insure less than 100% of the price on certain crops. Available Price Election percentages include:

Prevented Planting and Replant

The policy provides for coverage for Prevented Planting and Replant Coverage, however, the Crop or Special Provisions may modify or eliminate the coverage.

Unit Structure

Indemnities are calculated on each unit as elected by the grower. Unit structures available under the RP policy are:

- Optional Units (OU)

- Basic Units (BU), and

- Enterprise Units (EU – not available for all crops)